Overview of 1099 Correction Forms

If you notice an error on your previously filed 1099 Form, you need to correct it. Simply file a 1099 correction form and make sure to add the incorrect information along with the correct information. After making the necessary changes, retransmit it to the IRS, and send the corrected copy to your recipient as soon as possible.

The 1099 Correction Form is used for making corrections on the Form 1099 which you originally filed. There are two types of errors that can be corrected on Form 1099: Type 1 and Type 2.

Type 1 Errors

Incorrect tax amount(s), code, checkbox, or to void a return (if the return was filed when it shouldn't have been).

Type 2 Errors

A payee number is missing (ex. TIN, SSN, EIN, or ITIN), the name and/or address is incorrect, or the original return was filed on the wrong type of return.

When to Correct Your 1099 Forms?

If your 1099 Forms contain any errors, like incorrect tax amounts, codes, payees, TINs, or addresses, then they must be corrected immediately. The corrections must be made as soon as you come across the error or when the form is

rejected by the IRS.

Visit https://www.taxbandits.com/1099-forms/file-form-1099-corrections/ to know more about 1099 correction.

How to Correct a Form 1099 Online?

You can follow simple steps to rectify your 1099 form including Type 1 & Type 2 errors.

-

Identify the type of error, This will notify the IRS that the form has been previously filed.

- For a Type 1 error, provide the corrected information. Then add rest of the information just as it was reported originally.

- For Type 2 error, you can’t make the correction to the reported dollar amounts. You can make corrections to the various information for a Type 2 error, but dollar amounts submitted on this corrected return should contain zeros only.

- Refer the original 1099-MISC for fixing the correction. On the original form, the information must be noted exactly as it was.

- Mail the corrected 1099 form to the independent contractor, tax department, and IRS.

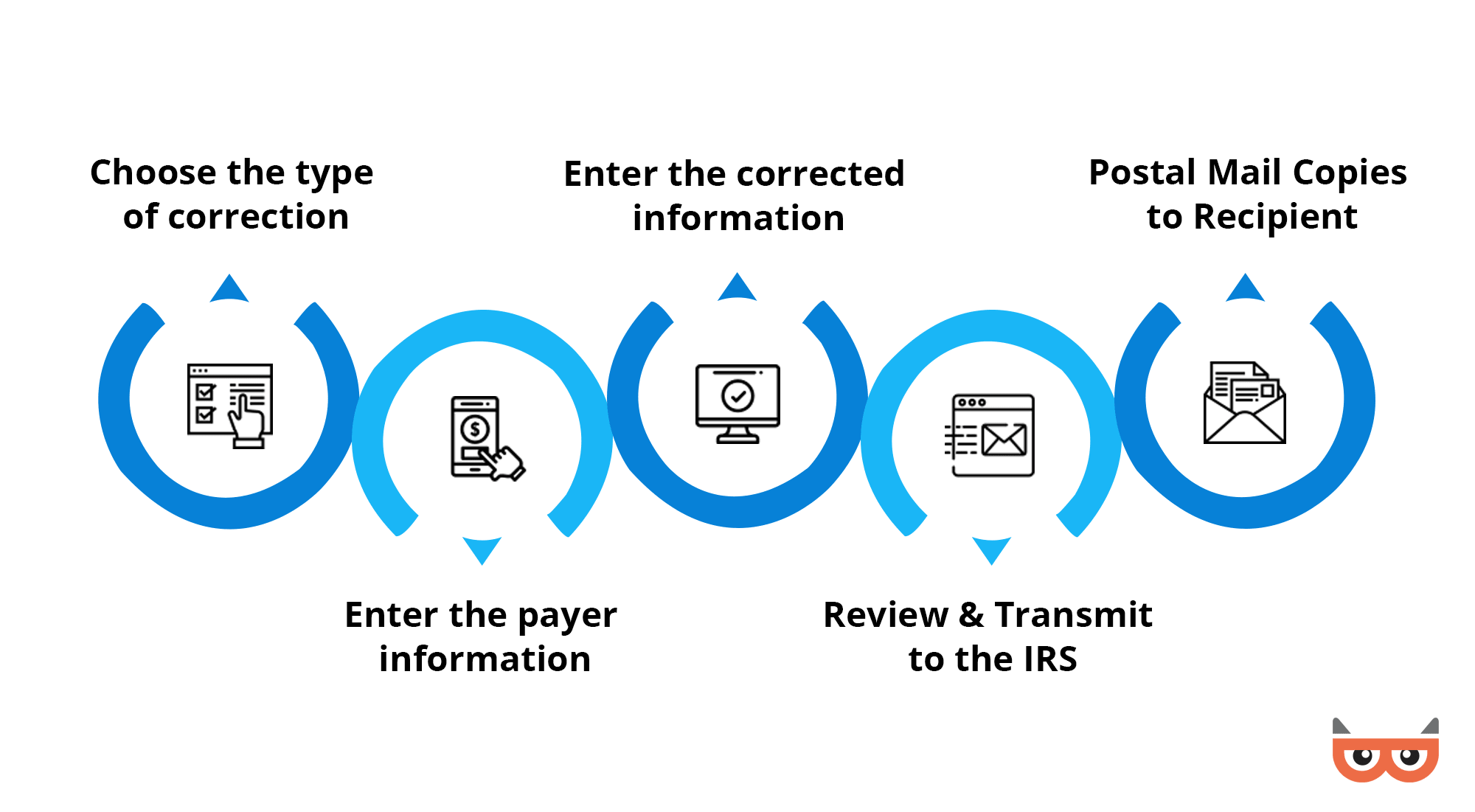

How to E-file Form 1099 Corrections?

- Choose the type of correction

- Enter the payer information

- Enter the corrected information

- Review & Transmit to the IRS

- Postal Mail Copies to Recipient

With 1099correctionform.com, you can e-file a 1099 correction for 1099-MISC and 1099-NEC forms to rectify type 1 or type 2 errors regardless of where you filed the 1099 form originally.

About 1099correctionform.com

E-filing 1099 with ease has been the unique selling proposition of 1099correctionform.com. The built-in error check mechanism ensures the internal consistency and completion in filling of forms. The application further provides print and mail provisions for sending payee copies instantly. The application allows to correcting form 1099 which is filled with other providers.

Form 1099 Correction Penalties

If you fail to file a corrected 1099 return when required and cannot show reasonable cause for not doing so, you may incur 1099 Correction Penalties. These penalties apply if you fail to include all correct information, paper file when you’re required to e-file, or fail to file paper forms that are machine readable.